Compounding Apartment Returns - Time in the Market Makes $$$$ [10 min read]

Robert Kiyosaki once said that, “It’s not about timing the market, it’s about time in the market.”

What he was eluding to was that some investors (‘speculators’) wait, hold, buy, or sell during times of fear and think that they can actually beat the market to make big bucks. After doing a little research, I found that if anyone has done this, those individuals were either lucky (lottery style luck) or extremely smart and rare (Warren Buffett).

I do not invest with ‘hope and prayers’ and am not extremely smart or rare – just average.

Here is a quick visual snapshot of the 3 types of thinking that I exhibited when trying to time the market during my formattable years investing in my early 20s:

What I have learned is that through a lot of research, years of testing, trying, failing, enduring, and forging forward, I have been able to find something that really works for me – APARTMENT REAL ESTATE.

Investment strategies vary widely. When I started out, I did the typical thing that I would assume most do; put my money into a Roth IRA, invest in a couple of ‘professionally’ managed funds, and sit back. It was a strategy that didn’t take much forethought, research, or time. What I didn’t realize was that there are many other strategies that if done correctly, can provide Proactive Wealth™. (I call it ‘proactive’ because you can’t sit back on your couch, eat potato chips, go golfing, and buy a fancy sports car because it takes some time to educate yourself in the ups-and-downs of apartment real estate)

I’m not knocking IRAs or funds – you can make money in these investment vehicles if you spend the time to know what you are putting your money in – BUT there may be additional options to continue to grow and diversify. What I didn’t realize is that several of my investment strategies did not take into account the fees, taxes, and poor oversight that can happen in a fund. Many fund managers start out with 10 funds to see which one works and then dump 9 of the 10 that don’t perform so that they can show the 1 fund that is making them money. Investors like to make money…why else would you chose to place your money into an asset class now if there wasn’t a potentially larger payoff in the future?

As the American economist Thomas Sowell explained, the study of economics shows allocation of scarce resources compared with alternative uses. Unless you are already wealthy, money is a scarce resource; something that isn’t abundant and endless. Additionally, there are many alternative uses for your money; car purchase, invest, buy food, give to charity… What you do with your scarce resource (money/currency) is up to you because there are many alternative uses (ETFs, REITs, mutual funds, stocks, bonds, banks, real-estate) that grow you wealth – some better than others.

In the interest of providing an unbiased review of how money compounds throughout the years, let’s look at 3x 10-year strategies using $30,000 of capital (all investment returns are re-invested each year):

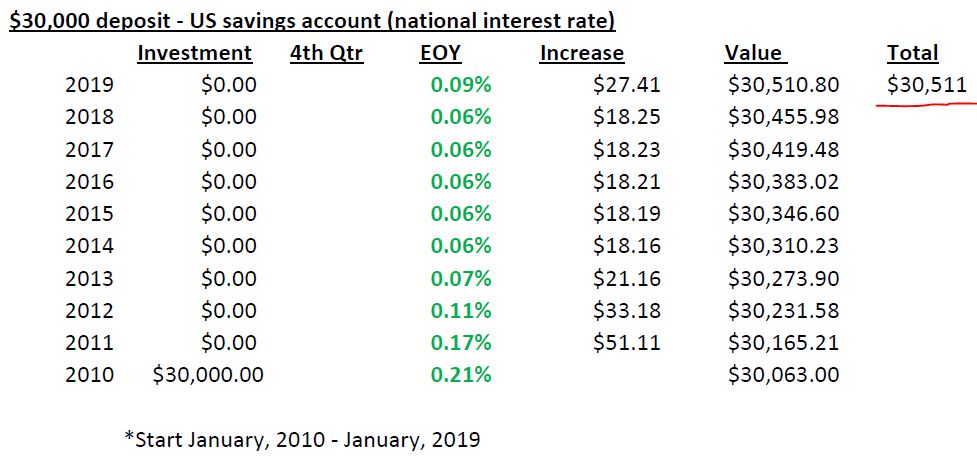

Savings account

- US national interest rate

- No tax implications considered

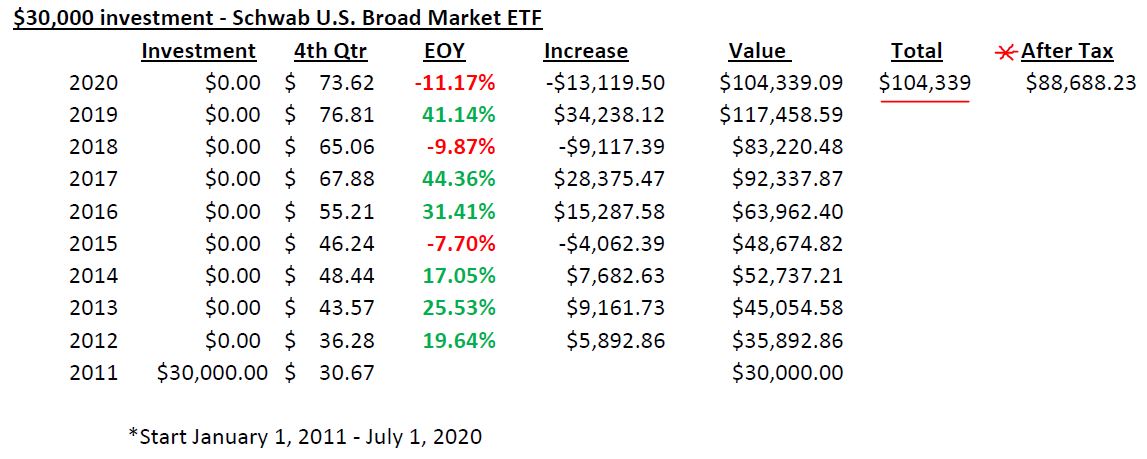

Randomly chosen ETF – “Schwab U.S. Broad Market ETF”

- 10-year timeline

- Tax implications considered ONLY at 10-year point

- Married filing jointly

- 15% rate ($80,001-$496,600) – reference 2020 tax chart below

- **I do not own stock in this company**

- Starting share price $28.56

- Cash out at the 10-year point

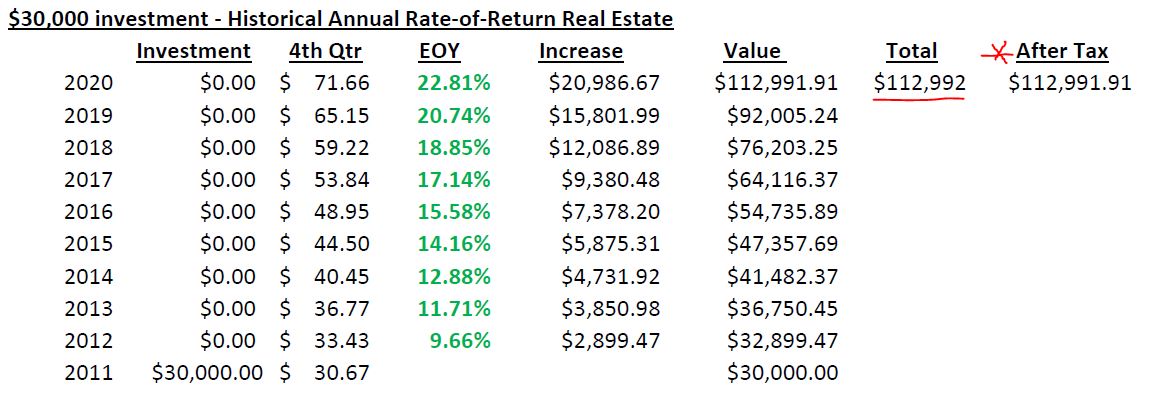

Real estate – I will use the historical rate of return HERE

- Not any specific real estate asset class

- Covers the entire USA

- There are many variables

- Tax implications = $0.00 (accelerated cost depreciation & tax planning strategies)

- For simplicity, we will use the same share price as the Schwab U.S. Broad Market ETF

Taxes can murder your future earnings potential

According to the IRS, for most individuals, capital gains usually isn't more than 15%...

What if you sold your property and profited $100,000?

BOOM! You now owe the IRS $15,000 immediately if you didn't do a 1031 exchange into another like property.

If you want an in depth explanation on the tax benefits of apartment real estate, you can purchase the “Single Seat Investor.” (100% of the proceeds are donated to the Anna Schindler Cancer Foundation)

You can run and re-run the above scenarios to disprove, alter, or massage the data to get the numbers that work for you; my goal wasn’t to prove or disprove any specific asset class - only you can decide what to do with your currency. I realize that there are many variables and this could be misconstrued as an over simplification of a complex idea…a 20-year study of the same data would provide a much different result due to the market correction in 2008.

In the interest of time, these specific scenarios show a couple of things:

- Savings accounts should never be used as an “investment account” (an emergency fund IS a good idea)

- ETFs are a way to grow your wealth if properly researched assuming you take into consideration taxes, fees, and all the fine-print

- Real estate does not have the liquidity that ETFs and savings accounts have but has beneficial tax implications that can be re-invested to further compound earnings as well as an asset class that is not directly tied to other markets

If you want to learn more about what we do and how we are helping people just like you, my book, “Single Seat Investor” is available for purchase on Amazon Prime for less than $10. This short book is easily read in 60-90 minutes and all proceeds are donated to support the Anna Schindler Cancer Foundation.

Buy the book here on Amazon Prime and start your path to financial freedom and WEALTH today!

Please feel free to comment below or contact me HERE with any questions.